Introduction

An all-too-familiar statement over recent years has been that the yield on long-dated government bonds (i.e. gilts) are at “all-time low” levels. Never has this been more true than now (the start of September 2019), where the yield on long-dated gilts has fallen to below 1.0% p.a. for the first time in history.

Before we consider the impact of plummeting yields, let’s start by putting into context how far yields have fallen over the last 10 years, and some of the key drivers behind periods of continued sharp falls.

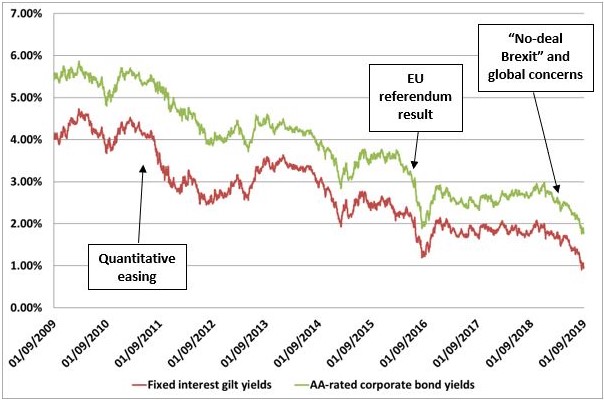

Figure 1: Movements in fixed interest gilt yields and AA-rated corporate bond yields between 2009 and 2019.

Source: Reuters.

Trustees and employers should now be pro-actively reviewing all aspects of their schemes in light of these developments.

Issues for consideration

As you will be aware, trustees (working alongside the employer and their advisers) are expected to manage their schemes within an Integrated Risk Management (“IRM”) framework. This essentially means that trustees should identify and assess risks and the impact that they can have on a scheme’s funding liabilities, investments and employer covenant.

Scheme funding – The large majority of schemes, particularly those that are relatively mature and are targeting self-sufficiency or buyout in the near future, continue to calculate their Technical Provisions (funding liabilities) based on discount rates which are directly linked to gilt yields. Lower gilt yields therefore lead to lower discount rates and higher liabilities (and therefore deficits). Whilst it could be argued that Technical Provisions and deficits are presentational problems, and that the true cost of providing pensions is dictated by actual member and investment experience over time, increasing deficits are a real concern and can have a tangible effect on corporate strategy.

Since 1 January 2019, long-dated gilt yields have fallen by around 0.9%. All other things being equal, this could easily increase a Scheme’s liabilities by anything up to 20%. Where there are concerns regarding the strength of the employer, you may wish to ask your Scheme Actuary to provide an approximate update of the scheme’s funding position.

From a wider perspective, you may also wish to consider whether continuing to base discount rates on all-time low gilt yields is appropriate – actuarial and investment advice would be essential here.

Transfer values and member options – Many trustees calculate their Cash Equivalent Transfer Values (“CETVs”) on a basis which is consistent with the calculation of their funding liabilities, i.e. linked to gilt yields, albeit with margins for prudence removed. However, whilst funding valuations are long-term planning exercises which essentially dictate the pace at which employers contribute to a scheme, CETVs are actual cash transactions which have a direct impact on schemes and individual members.

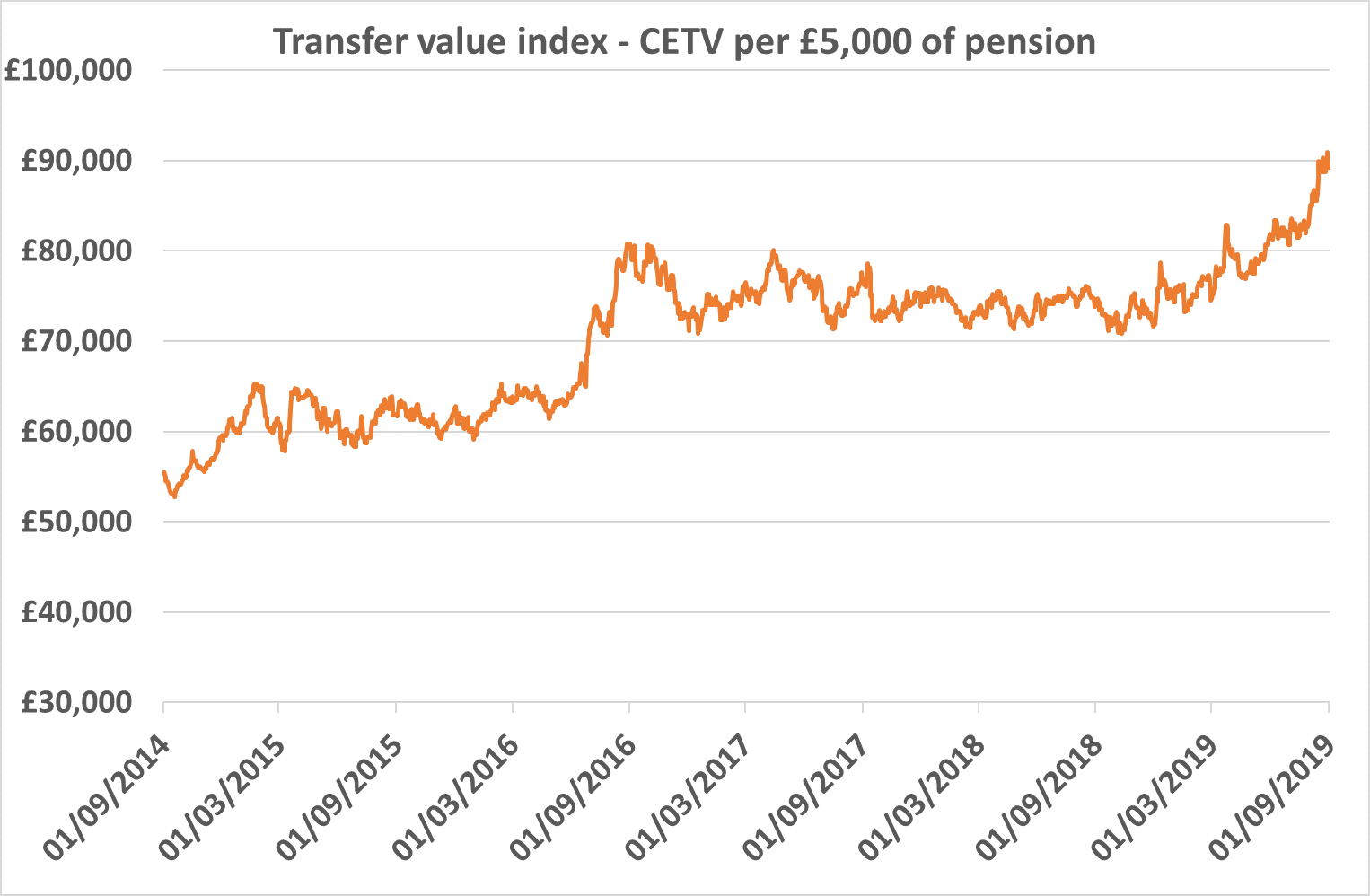

To illustrate the impact of falling yields, the chart below tracks an illustrative CETV calculation for a 50-year old member of a hypothetical scheme. If we ignore changes in mortality assumptions, the CETV for a 50-year old with a £5,000 pension in 2014 would have been c£55k. Fast forward to 2019 and the CETV for an identical 50-year old member would be c£90k, i.e. a 64% increase!

Figure 2: Hypothetical CETV for a 50-year old member with £5k annual pension. For illustration purposes only.

Source: Quantum Advisory.

Trustees should consider obtaining advice from their Scheme Actuary as to whether the current CETV assumptions remain “best estimate” ones. This is defined in the Pensions Regulator’s guidance as the “best estimate of the amount of money needed at the effective date of the calculation which, if invested by the scheme, would be just sufficient to provide the benefits”. By linking the discount rates to gilt yields, trustees are implicitly assuming that future asset returns will move in line with returns on gilts. Whilst it is favourable for a pragmatic and formulaic approach to be used for CETVs, trustees have a duty to ensure that the security of benefits for remaining members is not jeopardised by the payment of inflated CETVs. For poorly funded schemes with weak employers, it may be appropriate to consider paying (or reviewing) reduced CETVs.

A by-product of increasing CETVs is that the volume of quotation requests will inevitably rise, as will the risk of pension scams and fraudulent activity. This will undoubtedly place a higher burden on scheme administrators.

Whilst it is less common for schemes to have in place market-related commutation, early retirement and late retirement factors, the same principles apply here and advice should be sought from the Scheme Actuary.

Investment strategy – On the flip-side, many schemes have already taken action to protect their assets against gilt yield falls by increasing their exposure to low-risk assets such as gilts and corporate bonds, or even further, have put in place Liability Driven Investment (“LDI) solutions that can provide an enhanced level of protection. For these cases, the recent collapse in yields will have resulted in substantial increases in the value of assets. This would act to reduce or perhaps even eliminate the adverse impact of falling yields on schemes’ liabilities. Alongside this, growth assets have also generally performed strongly although there is a wide variability amongst diversified growth funds depending on the selection of the individual manager.

Linked to the above comments on CETVs, Trustees need to be mindful of the need to hold sufficient liquid assets to meet potentially high volumes of payments.

Another by-product of significant drops in yields for schemes with LDI protection is that large increases in market values can result in fund managers releasing capital back to the trustees. Investment advice should then be sought in relation to how these monies should be re-invested.

Employer covenant – The remaining IRM strand which should be considered is the employer covenant, i.e. the ability of the employer to pay the required contributions now and in the future. This should be considered in the wider context of the economy as a whole and the underlying factors which are seen as driving the fall in yields. Since June 2016, it has been crucial for trustees to attempt to understand how Brexit may affect the covenant. The level of uncertainty has only increased over recent months, alongside growing fears of a global recession, and trustees should be seeking information from employers as to the potential impact and any contingency plans which are in place.

Company accounting – Whilst the tendency for funding liabilities to maintain a direct link to gilt yields is not prescribed, it is mandatory for company accounting liabilities (i.e. the pension costs which feed through to a company’s corporate balance sheet) to be calculated using discount rates which are based on market yields on high-quality corporate bonds. As can be seen from Figure 1, corporate bond yields have seen similar falls over recent years, and this will directly impact the pension liability on companies’ balance sheets.

As set out above, a 12%-20% increase in liabilities since 1 January 2019 could be expected. The overall movement in the balance sheet item (comparing both assets and liabilities) will however depend to a large extent on investment performance. Whilst we would expect schemes to have benefitted from asset gains during 2019, this will vary from scheme to scheme and it is crucial for both trustees and employers to know where they sit within this spectrum.

To avoid any unwelcome surprises, companies could consider asking their advisers to carry out interim projections to the year-end, reflecting current market conditions.

Actions

Markets are inherently volatile and so we would not expect rash decisions to be taken as a result of recent developments. However, as a minimum, it would be sensible for trustees and/or employers to consider the following actions:

- Consider whether an interim funding update would provide additional comfort, particularly where there may be concerns regarding the employer covenant or de-risking triggers may be breached. A discussion should also be held (possibly at a later date) regarding whether funding discount rates should be directly linked to gilt yields.

- Ask the Scheme Actuary whether the approach used to calculate CETVs and member option factors remain appropriate or whether any interim adjustments are advisable.

- Monitor CETV activity and ensure that adequate member protection is in place and that payments will not be unduly delayed due to potential cashflow constraints.

- Pro-actively monitor the performance of the scheme’s investments and consider whether a more detailed review (e.g. an Asset-Liability Modelling (“ALM”) exercise) would be beneficial in terms of ensuring that the level of investment risk is appropriate.

- Obtain a more detailed understanding of the employer covenant, including the extent of any scenario testing which may have been carried out.

- Employers may wish to ask their actuaries for an early indication of what the FRS 102/IAS 19 position may be like at the next year-end, to avoid any unpleasant surprises.

If you would like any further information in relation to any of the above, please get in touch with your usual Quantum Advisory contact.