On 23 April 2019 the Pension Protection Fund (PPF) published guidance for trustees on contingency planning around the risk of an employer becoming insolvent (link). Planning can be done when times are good as well as when insolvency is imminent so that trustees are prepared. It is important that trustees:

- regularly review the employer’s covenant,

- understand the challenges they may face on insolvency,

- consider the risks posed by the employer’s financial situation, and

- ensure they have the right mix of skills, knowledge and expertise.

Contingency planning steps

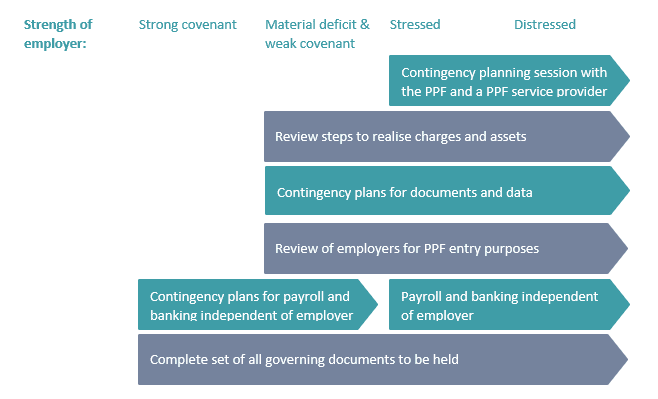

The PPF suggests that trustees can take various steps depending on the strength of the employer, as shown in their diagram below. Trustees need to ensure they can still get hold of information if they are unable to access the employer’s premises on a sudden insolvency event.

Much of the suggested planning is good practice anyway in the running of a scheme, but paying particular attention to the following can ensure that the PPF assessment period runs smoothly and members can be compensated quickly:

1. Governing documents

Trustees should ensure they have a working knowledge of these and that they are up-to-date, collated properly and held in more than one place.

2. Payroll and banking

Trustees should ensure that payment of pensions can continue if the employer fails by ensuring that there is access to payroll information and that funds are available, e.g. three months’ worth of payroll is held in a separate account.

3. Review of employers

Trustees should be clear about the history of participating employers so that the PPF can determine which members are eligible for compensation. Trustees should understand which employers are attached to the scheme and which members are attached to each employer.

4. Documents and electronic data

Trustees should consider maintaining a record of documents held and should ensure electronic data is backed up offsite, so that documents and data can be easily retrieved even it is difficult to access the employer’s premises.

5. Charges and assets contingent on insolvency

If the employer has given the scheme an asset or charge contingent on its failure, then the scheme will take over ownership of this on insolvency. Clear documentation is required for this to occur.

PPF assessment period

Following an insolvency event, a scheme enters an assessment period during which the PPF determines whether it is eligible for entry. This lasts around 18 months. The PPF will:

- assess whether the assets are sufficient to buy out the PPF liabilities with an insurer – if not then the scheme will transfer to the PPF which will then compensate the members,

- ensure that appropriate governance is in place,

- verify that benefits are paid in accordance with the scheme rules, and

- check that rule changes have been executed properly.

In order to do this the PPF will require information and assistance from the trustees.

Other relevant areas to consider

Trusteeship – The trustees need to have or have access to the expertise and experience required to deal with employer insolvency. There is help on the PPF’s website: https://www.ppf.co.uk/further-guidance-and-support.

Conflicts – The trustees need to be aware of any existing and new conflicts of interest, which can be employer, member or trade union related and have processes in place to manage these.

Members – Members are the priority. The trustees need to ensure they are kept in touch and any required tracing activity has been carried out.

Communications – Trustees need to ensure these are timely, clear and understandable.

Transfer values – Members considering transferring out need to be given support and understand the benefits they would be giving up, particularly the levels of PPF compensation.

Assets – The cashflow position will need careful management and arrangements will need to be made for disinvestment of assets, taking account of expected outgoings.