The Pension Protection Fund (PPF) first came into existence in 2006, providing a lifeboat for members of defined benefit (DB) pension schemes. They review the levy rules triennially, and last week they released their consultation on the next levy triennium (2018/19-2020/21).

They believe the introduction of the Experian PPF specific scoring in the last triennium was a significant step towards a more transparent and risk-reflective model. However, based on experience and input from relevant stakeholders, they hope that their proposals for the next triennium leads ‘to a more accurate assessment of solvency risk’.

Therefore, it is important to note that this consultation does not represent a total renovation of the current scoring methodology, rather a refinement of the existing methods and processes. Nevertheless, the proposed changes may have a significant impact for certain DB schemes and so trustees and companies alike should review these proposals carefully, since these rules will stand behind 3 years of levy invoices from 2018.

The PPF highlights that their initial analysis shows that (on the assumption that the total levy amount collected is unchanged) two thirds of schemes, mostly relating to smaller employers, will see a reduction in their levy. However, those employers who fall into the new large employer scorecard, may see an increased levy.

The proposals and questions posed are as follows:

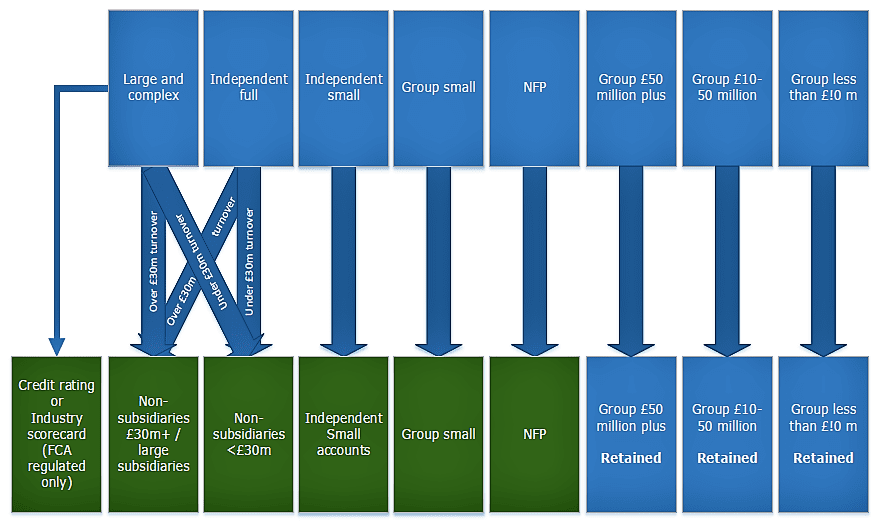

• Reconstructed and recalibrated Experian scorecards – Five scorecards have been reconstructed to give six ‘new’ scorecards (highlighted in green in the diagram below) and the remaining scorecards will be recalibrated “to give consistency of insolvency risk across all scorecards”. In particular, the ‘Large and Complex’ & ‘Independent full’ scorecards have been combined and then split into:

o Large subsidiaries (and parents) and non-subsidiaries with turnover of £30m or more;

o Non-subsidiaries with turnover under £30m.

Source: Consultation on the PPF levy Triennium – 2018/19 to 2020/21 March 2017

The Not for Profit scorecard has also been rebuilt to better ‘improve predictiveness’ by taking into account increased insolvency data available.

Importantly, for the most part, the remodelled scorecards no longer feature trend, mortgage age, employee based variables or indeed any non-account based measures. The PPF has raised concerns about the administrative burden placed on the relevant stakeholders in providing and sourcing this information. Due to the lack of data in foreign jurisdictions, the default position for foreign corporates has been to apply a ‘neutral score’ for the mortgage age variable in spite of the absence of secured charges. This will no longer be the case.

• Credit ratings converted into Experian scores for publicly rated companies and industry specific scorecards for FCA regulated institutions. This was implemented in the initial years of the current levy triennium but was later disregarded and instead entities were offered the option to certify credit ratings. The PPF’s analysis has shown that these ratings are a more suitable predictor of insolvency, and therefore they have sought to reintroduce using these ratings, where available, to determine insolvency risk.

• Averaging of the Insolvency Risk Score. The PPF has requested responses on the validity of the current method of averaging month end insolvency scores over a 12 month period. The two alternatives considered are:

I. A single score as at the 31 March

II. Averaging over a shorter period i.e. 6 months

• Simplifying the PPF levy system for small schemes. A third of DB schemes contribute only £10 million to the total PPF £615 million Levy. Therefore, on average these schemes will pay a c.£5,000 levy each year. In these cases, the PPF is concerned about the affordability of relevant actuarial advice with regards to the levy and therefore suggests the following possibilities:

I. Applying separate scaling factors to alter the proportion of levy charged from small schemes

II. Implementing a small scheme levy band to reflect the average insolvency risk posed

III. Offering the opportunity to opt-out of either of the proposals above if implemented

• Simplifying deficit reduction contribution certification (DRCs) either by removing the need to deduct investment expenses, or by simply certifying those contributions set out in the recovery plan. The PPF has raised concerns about the complexity of what was initially intended to be a relatively simple process. In particular, they make reference to the often ‘opaque’ charging structures for investment funds which can serve to increase the administrative burden and subsequent costs of certifying.

• Parental Guarantees and Certification of Contingent Assets – For realisable recoveries of £100m or more, the PPF proposes a requirement for an additional report completed by a professional advisor. There are also proposed changes for Multiple Guarantors and Guarantors who are employers.

• How Good Governance can be reflected in the levy if possible, without undue ‘administrative burden’.

The Experian Portal now illustrates the impact of the proposals on the insolvency risk scores, alongside current scores. We would recommend that the relevant stakeholders check these to see if there is an adverse impact on their score and subsequent levy banding.

Quantum Advisory is able to provide levy estimates to assist with budgeting for employers and trustees. Please contact us if you would like any further assistance.

The total levy required, with the associated levy scaling factor, will be broached at the next stage of the consultation later this year.

Quantum Advisory

March 2017