On 6 July 2017, the Pension Protection Fund (PPF) released its Annual Report and Accounts for the 12-month period ending 31 March 2017. The accounts show that the PPF remains in a strong financial position with reserves totalling £6.1 billion and a funding level ratio of 121.6%; an increase on reserves totalling £4.1 billion and a funding level ratio of 116.3% as disclosed in the 2015/16 Annual Report and Accounts.

The improvement over the period was largely due to the PPF’s investment strategy, which returned 16.0% over the 12 months; if the performance attributable to their LDI strategy is removed, then the portfolio returned 3.9% over the 12 months (1.6% above the benchmark).

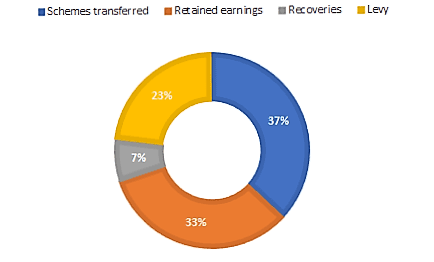

The assets under management increased by 23% to £28.7 billion. The composition of the assets by source since inception is shown in the chart below.

As per the previous year’s accounts, a reoccurring view is that the PPF is on track to meet its target of financial self-sufficiency by 2030. The projections produced by the PPF suggest that this target will be achieved with a 93% probability, consistent with the previous year’s projection.

Over the 12-month period to 31 March 2017, 63 schemes transferred into the PPF, bringing 12,000 additional members. Additionally, 103 schemes were in their assessment period, with assets and liabilities totalling £5.4 billon and £6.1 billion respectively. This deficit reinforces the PPF’s view that the £6.1 billion reserve over current liabilities is modest compared to the net deficit of the schemes it protects (£226.5 billion at as 31 March 2017).

Despite the recent events over the last 12 months, some of which needed direct intervention from the PPF, the accounts indicate a positive performance and the sentiment is reinforced through the various statements contained within the accounts.

Ryan Parsons