In April 2015 the Chancellor dropped a bombshell on the world of Defined Contribution (DC) pensions, allowing members to take their pension pot as cash instead of buying an annuity. This made DC pensions much more flexible than Defined Benefit (DB) pensions, meaning DB members must transfer out of their existing scheme if they want to access their pension flexibly. After a slow start, we are now seeing a significant increase in DB transfer value activity.

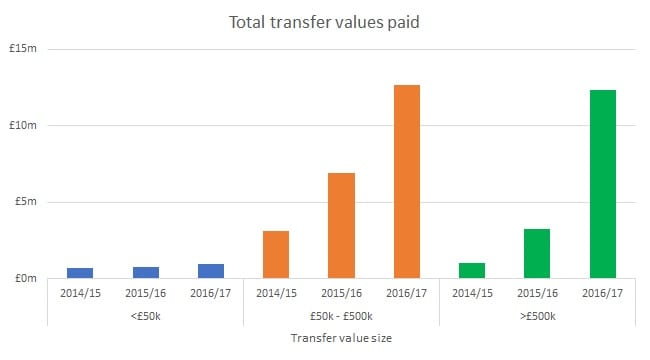

During the 2014/15 tax year (just before the new flexibilities were introduced) Quantum paid a total of £5m of Cash Equivalent Transfer Values (CETVs) from the schemes we administer. This increased to £11m in the 2015/16 tax year, then £26m in the tax year 2016/17. These figures are for individual transfers only and exclude bulk exercises.

The increase in transfer value payments has been driven by members with CETVs higher than £50,000, and the largest increase is for CETVs over £500,000. There are likely to be two drivers for this:

1. Members with a fairly large pension might feel that they have enough retirement income to live on, and can therefore afford to access some of their pension flexibly.

2. Members with very large transfer values might also want to leave some of their pension fund invested as inheritance for their family.

Interestingly, we haven’t seen a noticeable increase in members with small pensions deciding they would rather have the cash up front via the CETV route. This suggests that members do see a lifetime income as important, at least at a low level.

We also haven’t seen a decline in members commuting pension at retirement for tax-free cash. This seems inevitable in the longer term though, as some members who were considering taking tax-free cash look instead to access their whole pension flexibly via a transfer value.

Market movements

Part of the reason for the increase in the number of CETVs must surely lie in the recent increase in CETV values due to lower gilt yields on which CETVs are based. The CETV for an average 55-year-old has increased by 20% since the pension freedoms were introduced in April 2015, and by over 50% since 2010. This makes the CETV appear much more attractive, and may make it easier for a financial adviser to recommend transferring.

What should trustees be doing?

- Speak to your Scheme actuary. Trustees generally set their transfer value basis below the level of scheme funding, and this gives a funding gain when a member transfers out. However, the gain is often largest at young ages and might be small or non-existent as members get close to retirement. Over 80% of transfer values paid in 2016/17 were to members aged between 55 and 65, so trustees should consider reviewing their transfer value basis to make sure transfer values in this age band are set appropriately.

- Speak to your investment consultant. Most pension schemes do not hold enough cash to pay CETVs of the size we are now seeing quite regularly. That means trustees need to think about where they should disinvest assets from and what the costs of disinvesting are.

- Speak to your administrator. There is a wide range of transfer value policies across pension schemes. Some schemes actively offer transfer values to members at retirement, while at the other end of the spectrum some schemes don’t allow a member to take a transfer value after their statutory right expires one year before Normal Retirement Age. The more flexible and proactive schemes are likely to end up with greater member satisfaction and benefit most from an increase in transfer value activity.

- Consider allowing partial transfer values. The ultimate flexibility for members is to transfer some of their benefits to a DC scheme but retain some as a lifetime pension. We are seeing more requests from members for this flexibility, but whether trustees should offer it will vary according to scheme circumstances. A recent ruling by the Financial Ombudsman means it is good practice to state whether partial transfers are allowed when quoting CETVs.

Simon Hubbard