Northumbrian Water has embarked on a multi-pronged liability management exercise in a bid to control its defined benefit obligations, including a pension increase exchange and employer-funded financial advice.

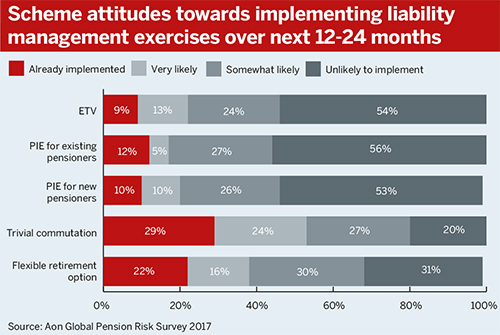

Pie exercises have seen increased interest from schemes recently. Twenty-seven per cent of respondents to an Aon 2017 survey, including trustees, scheme sponsors and pensions managers, said they were “somewhat likely” to implement a Pie for existing pensioners, with 26 per cent somewhat likely to carry one out for new pensioners.

Two new activities to manage Northumbrian Water’s scheme liabilities are being implemented in 2018, according to its latest financial statements.

“A pension increase exchange exercise is being carried out and transfer values are being included in members’ retirement data with the scheme offering to meet the cost of one round of financial advice,” the document states.

It adds that the potential financial impact of these activities was not recognised in the March 31 2018 valuation, but “is expected to be realised in the year to March 2019”.

Good communication is crucial

Pie exercises can also be beneficial to members. Stuart Price, partner and actuary at Quantum Advisory, said: “What you find is that many pensioners like the idea of having more money now, when they’re still relatively young in their retirement – healthy and active – and want to go off and spend a bit more.”

He noted that Pie exercises are relatively cheap to implement, but cautioned that communication is one of “the most important parts of the exercise” and “should be kept as simple as possible”.

He also highlighted the importance of guidance, so members can fully understand the offer and can make an informed decision.

Continue to full article here