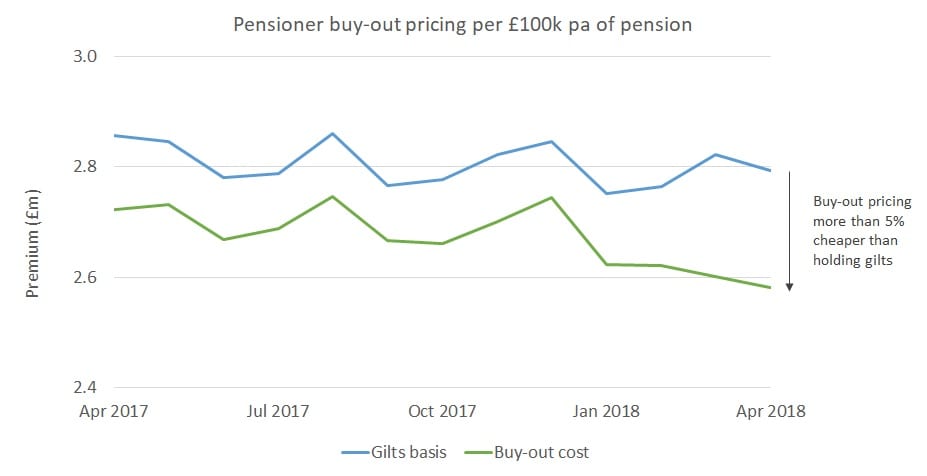

For the first time since our analysis began, we are seeing buyout prices more than 5% below the cost of holding gilts to pay pensions. This represents an increasingly attractive option for mature pension schemes that are looking to reduce risk and funding level volatility.

Trustees with defined benefit pension schemes will rarely want to run the scheme themselves until the last pensioner passes away. Instead they will, at some point, arrange for an insurance company to take over paying the benefits. This will either be as a buy-in, where the pensioners remain in the scheme, or as a buyout where the members leave the scheme and the insurer looks after them.

At Quantum, we track the typical pricing of buy-ins and buy-outs by working with a number of insurers in the market. This gives an idea of the what it might cost to buyout an average pension scheme. The analysis shows a trend of falling prices over the first few months of 2018, with the cost of buy-out (the green line) now materially below the cost of financing the same benefit by holding gilts (the blue line).

This improved pricing comes from a combination of market movements and changes in insurer pricing. During Q1 2018 corporate bond yields rose around 0.15% pa while gilts yields were broadly unchanged, and insurer pricing tends to be linked mainly to corporate bond yields. Market implied inflation was fairly stable, so the net impact was a reduction in price.

The increased difference between liabilities on a gilts basis and the buy-in/buy-out cost (the difference between the blue and green lines) offers an opportunity for schemes with a large proportion of gilts backing their pensioner liabilities to reduce risk at little, if any, cost.

Pricing for deferred members remains higher than for pensioners because of the additional risks they represent for an insurer. A scheme looking to sell gilts to fund a deferred member buy-in would still need to find an additional 10% – 20% on top of the value of the gilts.

The buy-in process

Transacting a buy-in will usually take a few months, but there are steps you can take to plan ahead and speed this up. These include:

• Ensuring that all scheme documentation is in good shape, including common sticking points such as Barber benefit equalisation.

• Ensuring that your membership data is complete and accurate.

• Reconciling GMPs with HMRC (note that you will need to equalise GMPs for gender differences as well before a buy-in).

We can assist with planning for a buy-in if you are considering this route.

Simon Hubbard, Senior Consultant and Actuary at Quantum

simon.hubbard@quantumadvisory.co.uk