Employees and Employers are missing out on National Insurance savings

Following April’s National Insurance (NI) contribution increase of 1.25%, the anticipated rush of businesses implementing a salary sacrifice arrangement as a more efficient way for employees to pay pension contributions and help offset the rise, has yet to materialise.

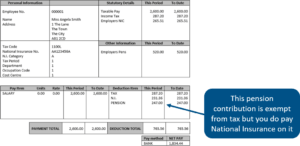

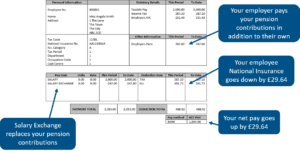

Employee pension contributions get tax relief however both employees and employers pay NI on the pension contribution. Salary sacrifice for employee pension contributions is an agreement between an employee and their employer where the employer pays the employee’s pension contribution to the pension scheme in addition to their own and the employee’s wage is adjusted to reflect this. As the employer is paying the employee’s pension contribution, no NI is paid on this by either the employee or employer and hence both make a NI saving. The result is the employee benefits in a net increase to their take home pay.

Many employers do not allow employees to pay contributions via a salary sacrifice arrangement and this generally stems from a lack of understanding of how it works and the benefits it provides to most employees and employers.

Stuart Price, Partner and Actuary at employee benefit specialist Quantum Advisory, believes the pension industry needs to make employers aware of the benefits of a salary sacrifice arrangement for employee pension contributions and then support employers to help staff understand the system and the benefits to them. Stuart said:

“As businesses and individuals feel the pinch with the increase to NI contributions and the impact of high inflation, salary sacrifice arrangements are an effective option requiring minimal effort to initiate.

“Adopting a salary sacrifice arrangement could make a real and noticeable difference for workers, in terms of take-home pay.

“For example, an employee on a salary of £30,000 paying a 5% pension contribution would see an increase in their annual take home pay of nearly £200. For employers, the annual saving is compounded against all of their workforce; if an employer has 100 employees paying a 5% pension contribution with the average salary being £30,000 then the employer will save over £22,000 per annum.

“To help employees understand the concept, a simple communication that shows an individual’s payslips before and after salary sacrifice raises the awareness needed and provides workers with the facts, allowing them to see the financial benefits before making an informed decision about joining a salary sacrifice arrangement.”

Example payslips (before and after salary sacrifice)

|

|

For further information about salary sacrifice schemes and how your company can best utilise them, visit www.quantumadvisory.co.uk.

ENDS

NOTES TO EDITORS

About Quantum Advisory

Quantum Advisory is an independent financial services consultancy that provides solution-based pension and employee benefit services to employers, scheme trustees and members and with a focus on tailored and practical advice and support from experienced professionals.

We have offices in Cardiff, London, Birmingham, Bristol, and Amersham servicing schemes and employers across DB, DC, hybrid schemes and a variety of employee benefits arrangements.

Our core services include investment consultancy, administration, actuarial consultancy, secretarial services, employee benefits consultancy, communications and health and wellbeing. Across all services we provide pro-active, solution-based thinking by investing in talented people and innovative systems.

For more information on Quantum Advisory visit www.quantumadvisory.co.uk