Many DB pension schemes now find themselves in a negative cash flow position (i.e. the contributions they receive from sponsors and members are less than their immediate outgoings for benefit payments). This is because:

(i) Many schemes have closed to future accrual;

(ii) Funding levels have improved, such that some schemes are no longer receiving deficit repair contributions; and

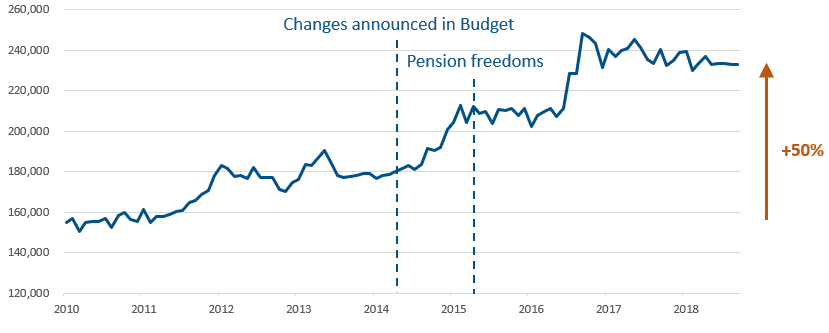

(iii) Pension freedoms have seen more transfers out of DB schemes in recent years.

How then to manage this transition to a negative cash flow position? What does the future hold for cash flows? And what is the impact on the day-to-day management of a Scheme? We asked three of our senior team to consider the issues in greater detail.

Actuarial

Simon Hubbard, Senior Consultant and Actuary at Quantum said:

“The increase in transfer payments has created peaks in short-term cash flows for schemes. However, these will not generally create a strain on a scheme’s funding level because trustees normally set their transfer value basis below the level of scheme funding. This gives a funding gain when a member transfers out. However, the gain is often largest at young ages and might be small or non-existent as members get close to retirement. Around 80% of the transfer values we paid in 2018 were to members aged over 55, so trustees should consider reviewing their transfer value basis to make sure transfer values in this age band are set appropriately.

The Pensions Regulator wrote to a number of pension schemes earlier this year with concerns about transfer values being too high. Trustees should make sure transfer values represent no more than the best estimate of the value of the member’s benefits unless the scheme is very well funded, otherwise members transferring out could disadvantage those remaining in the scheme. Trustees should also consider reducing transfer values if their scheme does not have enough assets to pay full transfer values to all members.

For most schemes it’s tricky to model expected future transfer values because of their “lumpy” nature. We know there will be transfer values paid out but we don’t know when or how large they will be. It’s the few very large transfers that make cash flow management tricky and these will often be difficult to predict.” ●

Administration

Jemma Jurgenson, Head of Administration at Quantum said:

“Transfers out of DB schemes have certainly increased since the pension freedoms were first introduced. We have seen a trend forming of deferred members transferring out prior to retirement in order to access their pension savings flexibly; this is now extending to members at retirement.

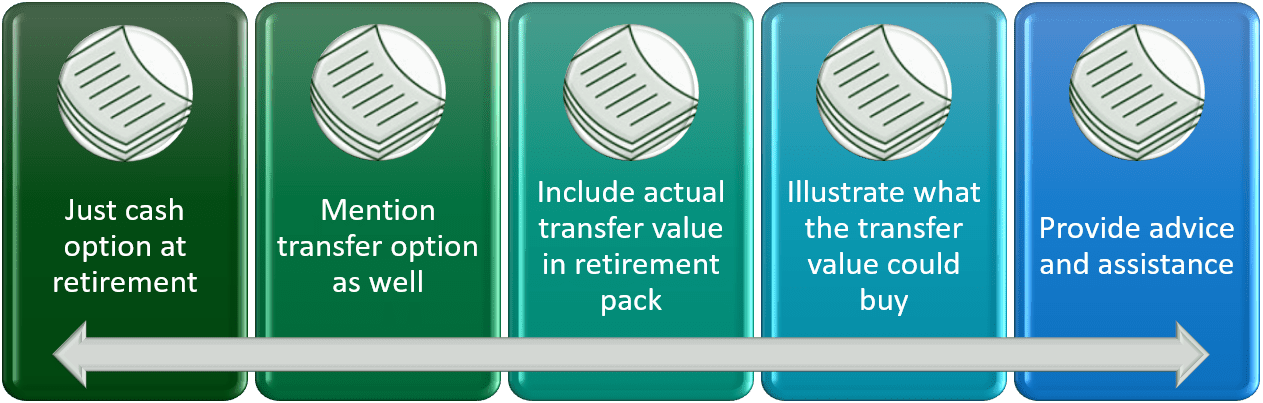

Increasingly pension scheme trustees want to offer members additional choices at retirement, not just the traditional retirement lump sum and pension. There are a range of alternatives that trustees are considering, from the standard pension and cash options at retirement through to quoting transfer options and making members aware of increased flexibilities. More schemes are now providing a full transfer quotation alongside the traditional retirement quotations at retirement. However, it is still rare for schemes to offer members free access to independent advice.

At Quantum we feel that the communication of these options is critical. Members who are not expecting to receive a transfer value alongside their retirement quotation are most likely to opt for the traditional pension options. For members to make the most of the choices available there needs to be improved communication, certainly in the ten years or so before retirement age, so that members feel able to make informed decisions.

Equally schemes and sponsors should consider the role of independent advisers in the retirement process. Offering members access to a meeting with an IFA as they consider their retirement options would further support members in their decision making.” ●

Investment

Amanda Burdge, Principal Investment Consultant at Quantum said:

“Most pension schemes no longer receive sufficiently large contributions and do not hold a big enough cash reserves to pay pensions and transfer values of the size we are now seeing quite regularly. That means trustees need to think about their income needs in greater detail.

This boils down to two key issues:

(i) How to deal with short term cash flow needs; and

(ii) How to effectively plan for future longer term cash flow requirements.

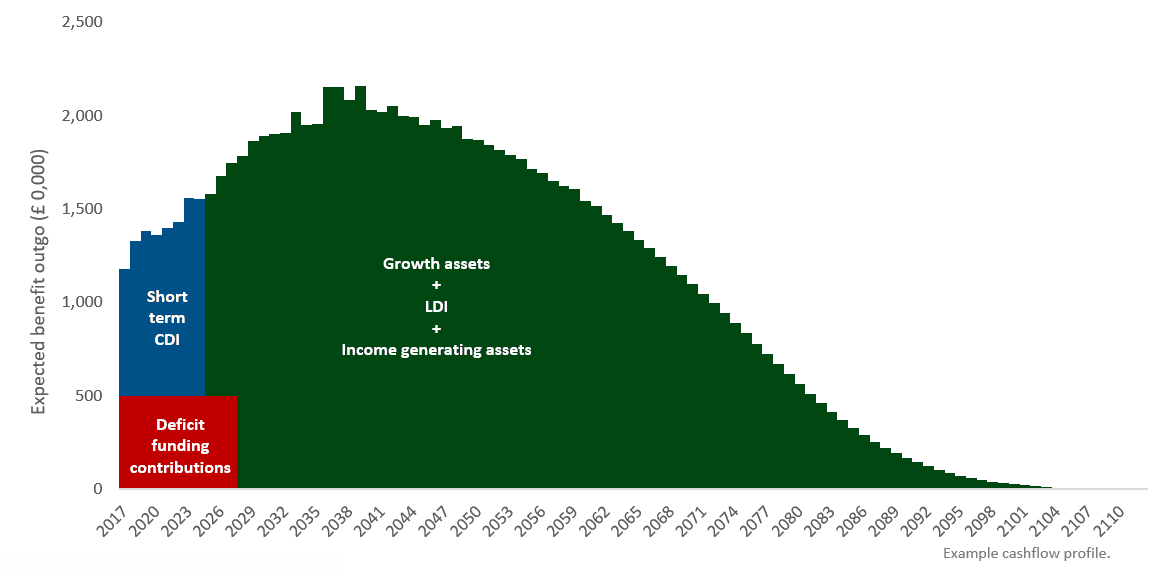

Whilst it is difficult to plan for transfer value payments, trustees should consider retaining some liquid assets to meet potential payments. In addition, the possible impact of any large transfer payments distorting the cash flow profile of the scheme will need to be analysed, particularly where there is an existing Liability Driven Investment (“LDI”) strategy.

For both short and long term income needs, Cash flow Driven Investment (“CDI”) strategies can certainly help, perhaps alongside growth assets and LDI to help close any funding gap.

CDI strategies can focus on both short term expected cash flows and the longer term income needs of a scheme. CDI offers trustees a return above gilts and greater certainty of return compared to a traditional growth portfolio. Whilst the solution may sound complex, it can actually provide trustees with a cost-effective, low governance solution to both short term and longer term income needs.

A number of our clients have implemented CDI strategies, or are considering how they can assist them in meeting the challenges of cash flow management.” ●

Summary

There are a number of issues to consider and at Quantum we recommend a holistic approach is taken. Our teams work closely with each other and trustees and believe early engagement and clear communication is essential if members are to make the most of their pension options. Equally a clear understanding of the interaction between cash flow management and investment strategy is key.