The Pensions Regulator (tPR) has recently published guidance on integrated risk management (IRM) for trustees, employers and advisers of trust-based defined benefit (DB) pension schemes, building on the guidance previously issued for assessing and monitoring the employer covenant and the DB funding code of practice. Further guidance relating to DB scheme investment strategy is expected to be published in 2016, which will complete the set of documents covering the interlinking areas which affect scheme funding.

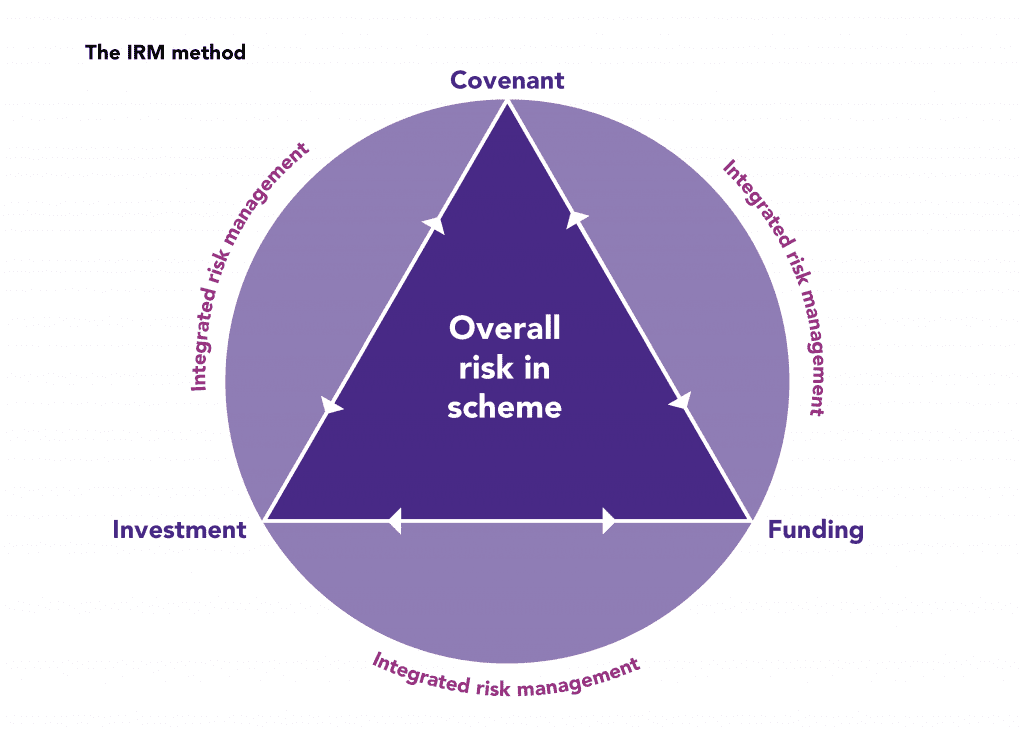

The intention is for IRM to act as a governance tool to assist trustees in identifying and managing the key employer covenant, investment and funding risks faced by pension schemes. The guidance should be read in conjunction with the DB funding code which provides a principles-based framework on how to comply with the statutory funding requirements contained in Part 3 of the Pensions Act 2004, i.e. to have sufficient and appropriate assets to meet the scheme’s technical provisions.

Key benefits

tPR identifies the key benefits of IRM as:

- Risk identification: to identify, prioritise and quantify the material risks to the scheme objectives and assess their interrelationships

- Better decision making: based on greater trustee and employer understanding of the material risks

- Collaboration: open and constructive dialogue between the trustees and employer about the material risks to each other’s strategies

- Proportionality: a focus on the most important risks

- Efficiency: effective management of trustees’, employer’s and advisers’ time

- Risk management: having plans in place to monitor and manage material scheme risks, allowing prompt reactions to events

- Transparency: easier explanation of decisions to third parties; especially where processes have been documented

Practical help and step-by-step guidance

The guidance provides practical help on what a proportionate and integrated approach to risk management might look like and how trustees could go about putting a framework in place. It states that trustees should consider introducing IRM regardless of where the scheme lies within its actuarial valuation cycle, rather than waiting until the next formal valuation is due.

There are five important steps associated with an effective IRM:

- Initial considerations for putting an IRM framework in place

- Risk identification and initial risk assessment

- Risk management and contingency planning

- Documenting the decisions

- Risk monitoring

Clear framework

The guidance is helpful, whilst not being overly prescriptive, and clarifies what is expected from trustees and employers. tPR has made it clear that an IRM framework should be implemented proportionately, with the end result being a structured process to monitor changes in the key risks more frequently than every three years as part of the formal valuation process. This will enable schemes to react quickly to events whilst avoiding knee-jerk reactions to shorter-term fluctuations.

The full guidance can be found by following the link below:

http://www.thepensionsregulator.gov.uk/docs/guidance-integrated-risk-management.pdf

Action

It is important for all trustees to consider how to implement an IRM framework and we would be happy to assist you with this.

Quantum Advisory

February 2016