The Local Government Pension Scheme (LGPS) is undergoing its latest triennial funding valuation as at 31 March 2022, with results expected later this year. The LGPS has over 6 million members, 18,000 participating employers and four actuarial firms appointed to carry out valuations across the 80+ different LGPS Funds. Each individual Fund will see differences in their 2022 valuation results however we can make some useful observations about the direction of travel since the last valuation in 2019 and explore the key issues that are likely to unfold in 2022 and beyond.

Where were we three years ago?

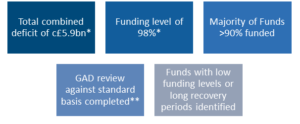

The last valuation was carried out as at 31 March 2019 and the results are summarised below:

*Based on an analysis of the funding reports for 86 of the 88 LGPS Funds at that time.

**The Government Actuaries Department (GAD) reviewed the 2019 LGPS valuations against a standard basis (established by the Scheme Advisory Board) and ranked the individual funds by their funding level on this basis.

What has happened since 31 March 2019?

Liability movements

The value placed on a pension schemes’ liabilities (i.e. the benefits promised to all LGPS members) is driven by the way that three key assumptions move over a period of time:

- The discount rate,

- The rate of inflation (which is generally used to set future member benefit increases before and after retirement), and

- Mortality rates (i.e. how long members will live for and hence how long their pension will be paid to them).

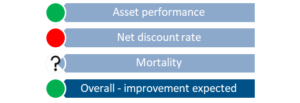

Many different approaches can be taken when setting a discount rate, but generally looking at the movement in fixed interest gilt yields over a period will give a good indication of how liabilities may have changed. Since the 2019 LGPS valuation, 20-year gilt yields have risen from around 1.5% p.a. to around 1.8% p.a.

With the cost of living crisis filling headlines, short term inflation rates are currently at levels not seen for many years, however, it is the long-term expectation of future inflation that is used to place a value on the LGPS pension liabilities. Since the 2019 LGPS valuation, market implied rates of RPI inflation have increased from around 3.5% p.a. to over 4% p.a.

Therefore, the net difference between the inflation and discount rate assumptions is likely to have increased by around 0.2% p.a. which could result in a c5% increase in liabilities. This rule of thumb is useful but of course cannot allow for things like a change of methodology by the Fund actuaries at this valuation. We will need to wait and see whether there are fundamental changes to the way these critical assumptions are derived.

Another major factor in calculating liability values is the mortality assumption. There is currently a lot of uncertainty around future mortality improvements with differing views on whether the long-term impact of the Covid-19 pandemic will be to increase or decrease future life expectancies. We expect the Funds’ actuaries will choose to make no allowance for the heavy mortality seen over recent years whilst they wait for credible evidence on the long-term effects of the virus.

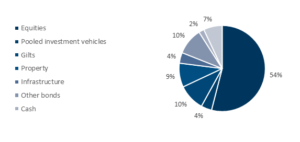

Asset movements

Each Fund will hold different assets and be implementing different investment strategies; however, the chart below shows the overall asset allocation across the whole LGPS at the 2019 valuation.

Performance of the major assets classes over the three years was as follows:

Based on a typical LGPS fund investment strategy which is invested approximately 70% in equities, 20% in corporate bonds an 10% in gilts, we would expect a three-year return of around 23% (or 7% p.a.). Clearly the investment return is heavily dependent on the exact make up of a Fund’s investment strategy and, in particular, how its equity allocation is split between UK and global equity.

In 2019, the discount rate assumptions used across the Funds varied from around 3.1% to 5.3% p.a. Therefore, we would expect asset performance to have a positive impact on the 2022 results across the LGPS Funds.

Overall impact on funding levels

Future cost of benefits for active members

In 2019 total future service contribution rates varied from 20% to over 35% of pensionable pay. The calculated cost of funding future service is not directly impacted by positive asset experience and, therefore, due mainly to the increase in expected net discount rates, we would expect to see an increase in required future service contributions as a result of the 2022 valuation.

Long term strategy

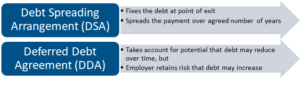

Many employers will have a limited lifespan in the LGPS and, when an employer no longer has any contributing employees, it will trigger a cessation event and an exit debt will be calculated on a “least-risk” or “cessation” basis. Due to the very cautious assumptions used for such a valuation, even employers with funding and accounting surpluses are likely to have significant deficits on a cessation basis; a deficit that is usually demanded by the Fund as a lump sum payment soon after the last contributing member leaves the employer.

Historically, leaving an LGPS fund was an expensive and uncertain business. Bespoke agreements were sometimes available but were subject to negotiation with individual Funds who all tended to take a different approach. In 2020, new legislation was introduced which standardised this process and required individual Funds to set out a policy for exit terms in advance. Two structured options were introduced, details of which are set out below:

Employers with guarantors my also be able to negotiate special exit terms with their Administering Authority, often paying less than the exit cost and sometimes making no further payments at all.

These options are helpful for employers because they present an avenue for them to manage their pension liabilities without the threat of an unaffordable exit debt suddenly becoming due. That being said, achieving a good outcome on exit is still a large project that needs careful management.

Next steps

Even if the likely increase in future contributions for the next three years is affordable for employers and exit from the LGPS is not on the immediate horizon, employers should still take steps now to review their LGPS strategy to make sure they avoid big problems further down the road, such as large unexpected exit debts. Having sight of the key issues at an early stage is critical for a employer when managing any defined benefit pension scheme, and managing the LGPS is no different.

Michael Welford

Consultant and Actuary

michael.welford@qallp.co.uk