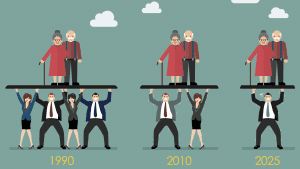

As we all know, some of the National Insurance contributions paid by those of us in work are used to pay the State Pension to those currently receiving it. We hope that by the time we reach State Pension Age, whatever age that may be, there are enough National Insurance contributions being paid by our children to pay for our State Pension, but that is an article for another day.

But surely, we do not pay for our parents’ private pensions too? Well I think we do. Let me explain why…

For those of us in our twenties, thirties and forties, many of our parents are from the golden generation where they are very likely to have been, for a significant period of their working life, a member of their employer’s defined benefit scheme. These schemes are now predominately closed to new entrants and us ‘youngsters’ now must join a defined contribution arrangement.

It is fair to say that in most, if not all, cases what is paid by employers into defined contribution schemes, and hence the ultimate benefits provided from these arrangements, are substandard compared to those of their defined benefit counterparts.

It could be argued that the reason employer contributions to defined contribution arrangements are low

is that defined benefit schemes have large deficits, which need to be plugged with significant contributions from employers. In an ideal world, if there were no deficits, employers could pay more contributions into their defined contribution arrangements. Therefore, as you can see, we are subsidising our parents’ private pensions too!

What can we do to overcome this?

Over the years, defined benefit schemes have fallen foul of legislation and are now riddled with extra guarantees that weren’t originally in place when these schemes were set up. This is great for our parents but comes at a cost with us ‘youngsters’ ultimately footing the bill.

The government could look to reduce or remove some or all of these guarantees on benefits already built up. This would help reduce or even eliminate deficits in defined benefit arrangements and therefore more employer contributions could be directed into our defined contribution schemes.

The end result would be a reduction in our parents’ benefits, which may not be palatable to them, but it would mean an increase in our benefits and in my opinion would help to create a more level playing field between generations.

Stuart Price

stuart.price@quantumadvisory.co.uk