This time last year we were all eagerly anticipating the launch of the new Pensions SORP. The revised SORP was applicable for accounting periods commencing on or after 1 January 2015, hence most administrators, auditors and trustees have now been through the process so we have the opportunity to step back and reflect on our experiences.

How did it go?

The general feedback given at the annual Pensions Research Accountants Group (PRAG) meeting in November was that overall it was easier than expected and that trustees found the new disclosures useful.

Fair Value Hierarchy

Early in 2016 the Financial Reporting Council (FRC) announced amendments to FRS102 fair value hierarchy disclosures for scheme years starting on or after 1 January 2017 and aligned these with International Financial Reporting Standards (IFRS), this would have been more beneficial if it had been agreed prior to the launch of the new SORP, however once released by the FRC most schemes adopted the disclosures early and this made the new disclosure simpler and most investment managers were equipped to easily provide the required information.

Investment risk disclosures

These new disclosures were always expected to be the more difficult area. There were always question marks over who would own this disclosure and with written disclosures there is always an element of subjectivity.

This did prove to be the most challenging area. They often turned into quite lengthy documents with inconsistencies between the rest of the report. There were different approaches to quantifying the different risk areas. A summary approach began to emerge however the presentation of the quantification varied.

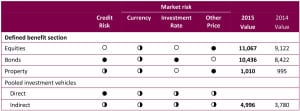

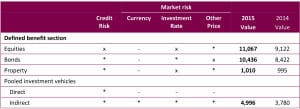

- There were moons

- there were ticks

- and there were asterisks

Going forward we expect to see some standardisation as to which of the above approaches to use. Following the first year of completion, it is hoped the owner of these disclosures has now been established and they have a template of the required format.

Annuity valuations

The valuation of annuities for the first time seemed to be received timely and accurately when actuaries were involved. Delays were encountered when the information was being delivered by insurance providers. It is hoped now the insurance providers have gone through the first year of providing the information, it will be a smoother and more efficient process in the future.

Way forward

There is still the overall question of how much do the new disclosures add value to the accounts and who reads the accounts. Additional costs were incurred in the transition to the new SORP, these will reduce going forward but the increased disclosures are ongoing.

For smaller schemes e.g. less than £10 million net assets, it raises the question of whether we really need the same disclosures as in a much larger e.g. £100million plus scheme, who do the additional disclosures benefit? The extra costs and time to prepare can be quite a burden for a small scheme, could we see a SORP adaptation for smaller schemes in the future e.g. something equivalent to the Financial Reporting Standard for Smaller Entities (FRSSE)? This would reduce costs and time of preparation for smaller entities. It is something that could be considered in the future but may prove difficult to justify that one pension scheme is more important than another purely based on size.

Suzy Lloyd