Over the course of the last twenty years, financial innovation has seen the development of a range of products that offer investors tailored strategies to better aid them in achieving their investment objectives. So called ‘structured products’ blend traditional asset classes, such as equities and bonds, with derivative securities in order to provide highly customised risk-return profiles.

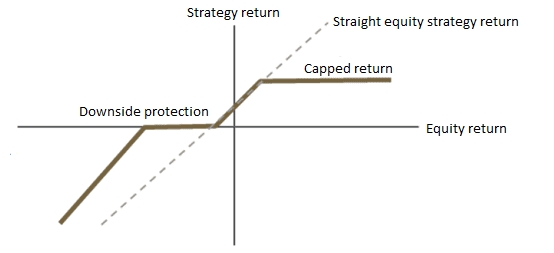

One such structured product, and one which is becoming increasing popular with Pension Scheme Trustees, is structured equity. This solution involves the use of equity options and/or fixed income securities, such as bonds, to create tailored exposure to equity markets. The aim of the product is to reduce downside risk exposure by foregoing a proportion of the potential upside.

Structured equity instruments, when blended with more traditional equity portfolios, can potentially narrow the range of expected equity returns and improve the certainty of investment outcomes, allowing pension schemes to customise their return profile.

Structured equity is often considered as a hybrid between active and passive equity investing, sometimes referred to as ‘enhanced indexing’. It seeks higher returns than traditional passive strategies by deviating slightly from an underlying index. An example could be sector tilts; increasing exposure to specific sectors that are expected to outperform, based on an economy’s position in the business cycle, whilst decreasing exposure to those which are expected to underperform. Controlling risk, is the main focus of a structured equity strategy, and as such, investors are likely to use a structured equity product to control tracking error whilst seeking outperformance against a specific benchmark.

A structured equity solution can be constructed using a variety of option strategies. This allows the exact pay off structure to be tailored to the needs of the individual pension scheme.

The example above shows one of the most common structured equity solutions, called a ‘put spread collar’. This involves purchasing a put option, which protects an equity return below a certain price, by paying an option premium – ‘downside protection’. Simultaneously, a call option is sold with the return capped at the amount required for the pension scheme to achieve its investment objective – ‘capped return’. A put option is also sold with a price set below the floor. Selling these options offsets the premium paid to buy the call option, thus lowering the cost of the strategy overall.

The prices of the options bought and sold can be adjusted so that the protection provided better matches a pension scheme’s risk return profile.

However, structured equity does not come without risk. Firstly, investing in structured equity products involves entering into a financial contract with a third party through derivative contracts; counterparty risk is inherent when engaging in these contracts and should be carefully managed.

Additionally, should equity markets move against expectations, investors will potentially face losses. For example, considering the put spread collar strategy described above, should equity markets experience a more precipitous decline than expected (as played out over the fourth quarter of last year), the pension scheme would be exposed to losses should the return generated fall below the level of protection.

Despite these risks, the benefits of providing customised exposure to asset classes and sub classes, that may not otherwise be easily accessible, as well as providing the additional benefits of diversification, make these structured products a practical and complementary addition to traditional investment options.

Matthew Tucker, Senior Investment Analyst