On 9 April 2019, the Pension Protection Fund (PPF) published its Strategic Plan 2019/22, which sets out its strategy for the next three years. The publication reveals positive news from the PPF, some of which is noted below.

31 March 2018 accounts

As at 31 March 2018, the PPF had £30billion of assets, with over 236,000 members – just under half of whom are in receipt of PPF benefits. The accumulated assets have been raised by four main sources of income:

- Assets from pension schemes transferred to the PPF: 37%

- Investment returns: 26%

- Levies collected from eligible pension schemes: 23%

- Recovered assets secured from insolvent employers: 14%

The PPF has a long-term funding target to be 110% funded by 2030. This target is regularly reviewed with the latest modelling suggesting that out of one million scenarios tested, the long-term funding target would be met 91% of the time. This result has been achieved despite, in the last financial year, the largest pension scheme to have entered into the PPF; Kodak Pension Plan (No 2) which had a deficit of £1.5billion.

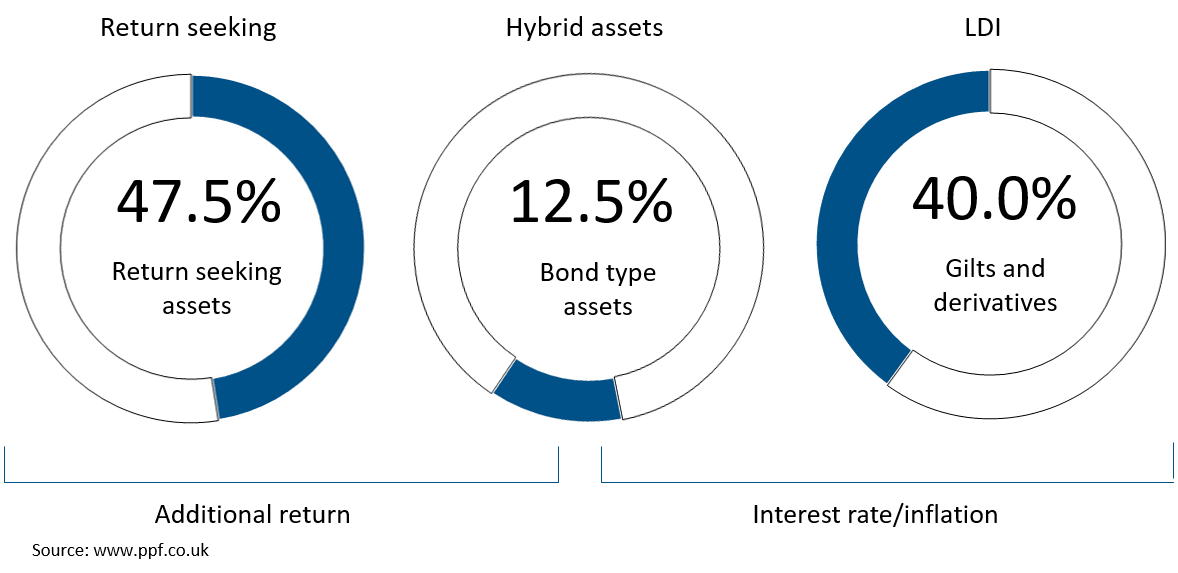

The PPF credits the return generated from its invested assets as a key driver to meeting its long-term funding target. The invested assets can be split into the following three main classes:

Interestingly, the portfolio is designed for an expected long-term return of assets to outperform liabilities by 1.5% pa.

The PPF levy

The PPF is estimating that it will collect c£500million from the 2019/20 levy. It does not expect the investment, levy or funding strategies to significantly change over the period of its Strategic Plan. Therefore, any change in the levy is expected to be due to change to the funding level of the pension scheme and/or the insolvency risk associated with the sponsoring employer.

Whilst it was announced in February 2019, the PPF re-confirms that Dun & Bradstreet will replace Experian as the provider of the insolvency risk scores for use in the levy calculations for levies issued from 2021/22. The starting point to generate insolvency risk scores will be based on the existing model and amendments will only be proposed where evidence suggests a change is warranted.

Service to members and schemes

The PPF is committed to providing an excellent service to members. This includes regularly surveying members and analysing the responses following members calling the services team or accessing the member website.

Steps have been taken to provide members with a newly designed website which provides a user friendly experience. It is hoped that 70% of member transactions will be undertaken online by March 2022.

In February 2019, the PPF launched a SME levy forum, which was attended by one of Quantum’s actuaries. Future meetings are due to take place which will further enhance the PPF’s role of communicating to various stakeholders.

Separately, the PPF published its Business Plan 2019/20 which identifies key milestones and planned activities over the next 12 months. Both the Strategic Plan and Business Plan can be found in full on the PPF’s website at https://www.ppf.co.uk/strategic-plan

Ryan Parsons, Consultant and Actuary