Introduction

Whilst many sceptics viewed this week’s Queen’s Speech as nothing but a high-profile party-political broadcast, it was of particular interest to the pensions industry as it finally confirmed the inception of a long overdue Pension Schemes Bill:

“To help people plan for the future, measures will be brought forward to provide simpler oversight of pensions savings. To protect people’s savings for later life, new laws will provide greater powers to tackle irresponsible management of private pension schemes.”

The Bill itself (196 pages) was subsequently published on 16 October 2019 and is now working its way through the House of Lords.

The main items covered in the Bill will come as no surprise, as it follows on from other clear statements of intent from the DWP over the last two years. As tends to be the case with primary legislation, it also doesn’t contain the level of detail which allows a meaningful impact assessment to be carried out (this will be covered in future regulations and Codes of Practice). There are however some notable absences in the Bill and we will touch upon those later in this document.

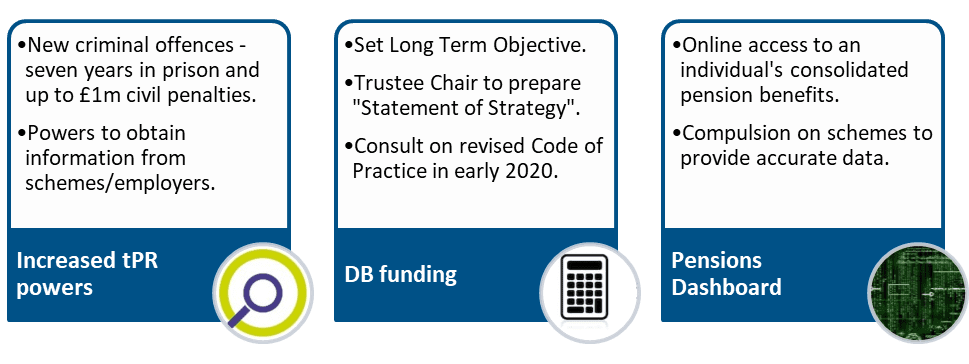

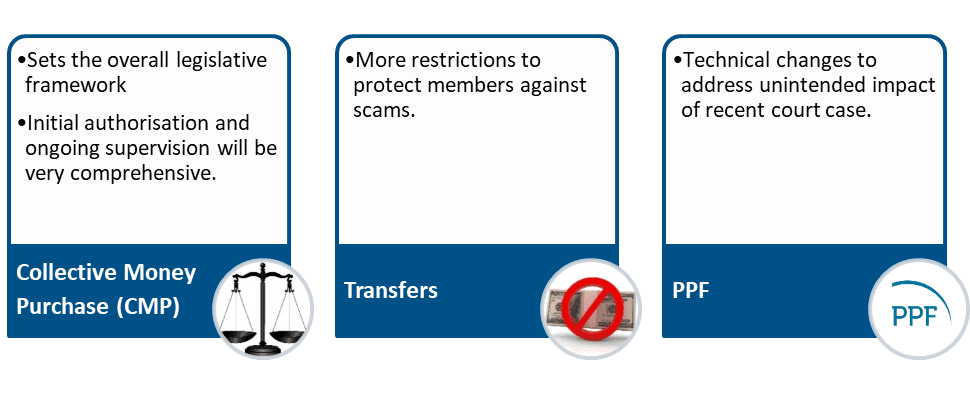

What is included?

The six main policy areas covered by the Bill are as follows:

What wasn’t covered?

- Consolidation – the most unexpected omission from the Bill was the setting of a regulatory framework for commercial consolidation vehicles (commonly referred to as “superfunds”). It is understood that concerns remain regarding how it can be ensured that these solutions are not given an unfair advantage over the highly-capitalised and strictly-regulated buyout insurance companies.

- Section 75 debt reform – consistent with the message in the 2018 White Paper, the Bill does not include any provisions for addressing the perceived unfair treatment of participating employers in multi-employer schemes such as the Plumbing and Mechanical Services (UK) Industry Pension Scheme.

- GMP equalisation – it had been hoped (but not expected) that the Bill would legislate in certain areas relating to the equalisation of GMPs, including conversion and the tax treatment of any resulting benefit uplifts. The DWP has previously indicated that legislation will be required and we expect this to be addressed during 2020.

- Auto-enrolment – the government has resisted calls for the Bill to build upon existing auto-enrolment legislation by reducing the minimum age from 22 to 18, widening the eligible earnings definition and increasing minimum contribution levels.

- RPI/CPI – sensibly, given that the recent announcement regarding the phasing out of RPI as a measure of inflation may not actually materialise, the Bill does not legislate for any change in this area.

Comment

Whilst including the much needed framework for CMP schemes (formerly referred to as CDC schemes), the focus of the Bill is undoubtedly on strengthening the Regulator’s powers in areas it considered were lacking.

After criticism of the current legislation by Frank Field’s committee following the Carillion and BHS failures it will be very interesting to see what is added subsequently to this Bill. Will it go through Parliament unscathed? Time will tell.

We will delve deeper into the expected changes to the defined benefit funding regime at the upcoming seminars at the Celtic Manor, South Wales on 13 November 2019 and in London on 22 November 2019. Please get in touch with your usual Quantum Advisory contact to reserve a place or to discuss the contents of this document in further detail.